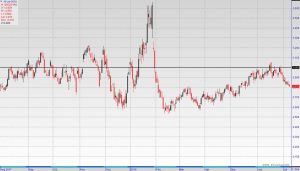

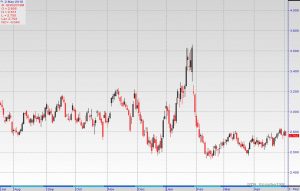

Technically, the main trend is down according to the daily swing chart. The downtrend was reaffirmed when sellers took out the previous main bottom at $2.821. If this continues to generate impressive downside momentum then look for a possible extension of the selling into the next major bottom at $2.727.

Natural gas futures are trading lower early Tuesday. Although there is heat in the forecasts, it’s not impressive enough to stop the current price slide. It’s also not enough to offset rising production that is raising hope that the supply deficit may be filled by the start of winter.

At 0944 GMT, August Natural Gas is trading $2.806, down $0.022 or -0.78%.

NatGasWeather supports the notion that that recent guidance has failed to offer enough heat in the Northeast for the second half of July.

“It’s still a hot overall U.S. pattern with upper high pressure dominating large stretches of the country, just not impressively so with the Great Lakes and Northeast only experiencing bouts of heat, but not sustained,” the firm said. “The latest midday data maintained a weather system arriving into the northeastern U.S. Thursday and Friday, cooling hot early week conditions.”

“Although, upper high pressure is expected to spring back across the U.S. this weekend for a swing back to stronger demand as most of the country returns to highs of upper 80s to 100s,” NatGasWeather said. “But where the data still isn’t hot enough is across the Midwest and Northeast during the middle and end of next week as weather systems with showers and cooling ride around the northern periphery of the hot ridge.”

Technically, the main trend is down according to the daily swing chart. The downtrend was reaffirmed when sellers took out the previous main bottom at $2.821. If this continues to generate impressive downside momentum then look for a possible extension of the selling into the next major bottom at $2.727.

The main range is $2.727 to $3.043. Its 50% to 61.8% retracement zone at $2.885 to $2.848 is new resistance. Unless the heat dome returns, spreads across the country and production falls, buyers are going to have a hard time recovering this zone. Even if they did, hedgers would be waiting to refresh their positions. This may be the only reason for profit-taking or a short-covering rally.