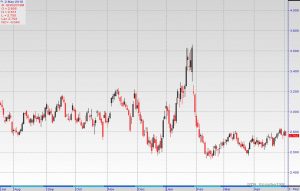

As 2016 begins, the energy industry remains uncertain of when the oil and gas sector will turn around — and companies are taking steps to streamline operations until prices begin to recover.

That is according to BDO USA, whose annual survey found that 85 percent of U.S. oil and gas chief financial officers (CFO) are predicting low oil and gas prices to be their greatest financial challenge in 2016 — and many energy companies are looking to tighten their belts by selling off assets.

The survey also found that 75 percent of energy CFOs expect M&A activity to rise in the coming year — up from 56 percent last year. Though activity was slower than expected in 2015, deal pace has already started to pick up, with industry giants like Schlumberger and Shell acquiring smaller rivals who have been struggling in this tumultuous pricing environment. Not surprisingly, just under half (49 percent) of CFOs believe undervalued oil and gas assets will be the primary driver of transactions as larger companies and investors home in on struggling companies seeking to shed distressed properties and business units.

The energy sector’s increased pessimism about their ability to access capital and credit may also catalyze deal activity in the months to come. The percentage of CFOs who feel worse about their company’s access to capital has more than doubled — from just 20 percent in 2015 to 45 percent this year. During October 2015’s debt redetermination period, many heavily-indebted exploration and production companies saw reductions in their borrowing bases, which has already produced operational impacts: 45 percent of CFOs experiencing project delays or terminations over the past year cite lack of capital as a leading cause.

“Throughout 2015, we saw many M&A players hesitant to engage in deal activity, likely because sellers hoped the bust cycle would balance out throughout the year and drive valuations up,” said Charles Dewhurst, leader of the Natural Resources practice at BDO. “However, as we enter the New Year, they are letting go of the idea of rapid recovery and may look to sell before valuations bottom out further.”

With debt financing becoming increasingly challenging for energy companies, many are increasing their reliance on private equity to keep afloat. Fifty-five percent of CFOs surveyed say they are likely to utilize private equity as a source of outside capital in the coming year — up from 50 percent last year and 40 percent in 2014.

CFOs are rethinking expenditures and planning to be more conservative in funding new investments as commodities prices continue to hover near record lows. Despite the Obama administration’s decision to permit offshore drilling in the Arctic and Atlantic last year, only 1 percent of CFOs say they will be increasing capital investment in offshore exploration — down from 23 percent in 2015. Meanwhile, the number of CFOs planning to increase investment in non-conventional plays dropped from 47 percent last year to approximately one in three CFOs this year.

In addition to cutting back on investments, oil and gas companies are making tough decisions as contracting prices force them to scrutinize their labor costs. Seventy-one percent of CFOs hope to keep staffing levels consistent with last year, while 9 percent of CFOs say they are likely to reduce their labor force in order to increase profitability, up from 1 percent last year. Those employees who do survive the cuts are likely to personally feel the impact of tightening budgets: Fifty-seven percent of CFOs expect employee bonuses to be smaller for fiscal year 2015.

“Executives must balance the need to bring costs down with the very real risk that a large reduction in labor force may catch them on the back foot when prices begin to climb again,” said Jim Willis, senior director of compensation consulting in the Global Employer Services group and a member of BDO’s Natural Resources practice. “The industry is threading this needle for now by effectively implementing a hiring freeze, but if prices remain low for much longer, more companies may need to seriously evaluate reducing their headcount.”

While commodity price volatility remains front and center, focus on environmental regulation wanes. Given the state of the industry, it’s unsurprising that concerns about environmental compliance risks have lessened considerably, with about one in five CFOs citing it as the primary area of focus for their risk reduction activities compared to 61 percent a year ago. Investments in environmentally friendly exploration and production technologies have also grown less feasible for many companies: Just 22 percent of CFOs plan to increase their investment in this area, down from 35 percent in 2015.