This week’s EIA storage report is expected to show an injection of 70 Bcf, in line with the 5-year average. After two consecutive bearish storage reports,

this one may be the one that finally drives out the lingering long speculators. Additionally, on Friday, the EIA will release its monthly production report.

If it shows rapidly growing production then look out to the downside.

The top-step natural gas futures contract is trading higher early Wednesday for a second day as investors continued to show respect for a pair of market bottoms and a major technical support zone.

The price action may also be related to position-squaring ahead of the expiration of the July futures contract on Wednesday.

The August Natural Gas futures are trading $2.991, up $0.055.

The sideways price action this week is related to mixed weather data showing slightly cooler temperatures for the first week of July, but a generally hot temperature pattern for the June 20 to July 6 period.

Besides the ever-changing weather forecast, investors are also watching production. According to Genscape, Inc., on Monday, production volume was more than 1 Bcf/d higher than last week’s volumes and are hovering near record levels.

Based on this figure, the Mobius Risk Group is saying that an additional 1 Bcf/d of production growth from this point through the end of the storage injection season would still leave end-of-injection season storage levels at less than 3,600 Bcf, assuming flat year-on-year demand and normal temperatures.

As far as the weather is concerned, NatGasWeather.com is saying its Global Forecasting System forecasting model is predicting temperatures a little hotter for July 9-11. Overall, a bullish pattern is expected beginning late next this week into mid-July as most of the country is forecast to see temperatures warm to above-normal levels.

Forecast

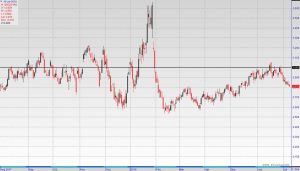

The chart clearly shows higher bottoms at $2.896, $2.891 and $2.883. This in addition to a technical 50% to 61.8% support zone at $2.885 to $2.848. These levels have to hold in order to form the technical support base needed to drive the market through $3.043.

However, there is a problem and it is rising production that is offsetting any forecasts for above-average temperatures. At this point in the season, production has to plunge, or temperatures have to spike higher and stay there for a while to generate the buying strength needed to overcome $3.043.

The weather is too unpredictable to count on and production is not likely to fall unless there is a major supply disruption so we have to conclude that the next rally is likely to fall short of last week’s high at $3.043. This, combined with seasonal selling pressure makes natural gas vulnerable to the downside.

This week’s EIA storage report is expected to show an injection of 70 Bcf, in line with the 5-year average. After two consecutive bearish storage reports, this one may be the one that finally drives out the lingering long speculators.

Additionally, on Friday, the EIA will release its monthly production report. If it shows rapidly growing production then look out to the downside.