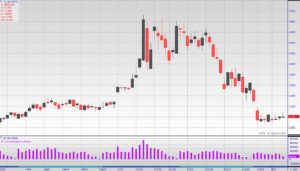

Natural gas futures are trading higher on Wednesday,

clawing through several retracement levels as bulls try to trigger a technical

breakout to the upside.

The strong rally actually started on Tuesday after

increasing production and a lack of significant cooling demand drove prices to

their lowest level since April 25.

The late session technical bounce wasn’t strong enough to

produce a potentially bullish closing price reversal bottom, but it was

significant enough to confirm a value area for speculators between $2.550 and

$2.534.

At 12:28 GMT, July natural gas

futures are at $2.624, up $0.040 or +1.55%.

While the strong rally may be an indication of

position-squaring and short-covering, speculators are still facing a wall of

resistance at $2.632 to $2.641.

The buying pressure will increase over $2.641 with $2.659

the next target. If this move is able to generate enough upside momentum then

the rally may even extend into $2.679.

It will be difficult to extend the rally beyond this

level, however, unless the weather turn extremely hot.

The price action since April clearly shows that buyers

have identified $2.550 to $2.534 as a value area. Furthermore, major long-term

bottom is $2.510.

Short-Term Weather Outlook

According to NatGasWeather for May 29 to June4, “Weather

systems with showers and thunderstorms continue across the West and Plains with

highs of 60s and 70s,

although gradually warming into the 70s to 90s by the

weekend. Texas to the Mid-Atlantic Coast will be very warm to hot with highs of

80s & 90s as strong high pressure dominates,

hottest across the Southeast with 95-100F. Mostly warm

conditions continue from Chicago to NYC with highs of 70s and 80s, although

with showers across the Upper Midwest.

Hot high pressure over the Southeast will weaken late

week in the week through the weekend as weather systems advance across the

northern US with showers.

Overall, demand will be moderate through Thursday due to

hot conditions over the southern US, then low as coverage and intensity of 90s

eases.”