02/25/2015 07:45

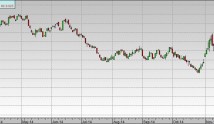

After finishing a relatively quiet day of trade with a modest 2.3-cent gain

at $2.902/MMBtu, March natural gas futures continued in quiet trade overnight

ahead of the Wednesday, Feb. 25, trading session, with the contract’s

expiration at the close. While moving shallowly on either side of the prior

day’s settle in a $2.887/MMBtu to $2.930/MMBtu spread, the front-month was last

eyed stalled at $2.94/MMBtu, up 4 cents.

Short-covering allowed the contract its modest upside in the prior session

as traders worked to cover positions ahead of the contract’s roll off the

board, with ample amounts of cold weather in forecasts to drive some gains.

However, weather forecasts for the upcoming six- to 10-day period have been

largely unchanged and the market is running out of steam off of the outlooks

that show below-average temperatures dominating the majority of the country. A

swath of average temperatures will span from the Southeast into a portion of

the Gulf, while another area of average temperatures will span along the coast

of California. Above-average temperatures will be confined to portions of the

Southeast and Gulf.

Further, in the eight- to 14-day projection, while below-average

temperatures continue to dominate, the intensity of the cold is diminished

across the bulk of the country. While a similar area in the Southeast and Gulf

will see average and below-average temperatures, the area of average

temperatures expands in the West to encompass areas of the Northwest and

Southwest in addition to California. Meanwhile, the California coastal areas

will see above-average temperatures.

Taking note of the time of year, as winter continues its end-run and spring

gets set to sprint, the market anticipates little threat to the natural gas

supply, and with a healthy end-of-season inventory on tap, continues to find

only modest support for small bursts of short-covering, but no real support for

a sustainable move back above $3/MMBtu.

The market is nonetheless poised for the midmorning release Thursday, Feb.

26, of U.S. Energy Information Administration storage data that will cover the

week to Feb. 20, when cold weather blanketed major heat-consuming portions of

the country, unleashing demand.

As a result of the cold that generated 53.7% more heating degree days than

last year and 40.2% more than normal, according to National Oceanic and

Atmospheric Administration data, natural gas storage withdrawals are expected

to ramp-up beginning with this week’s inventory report and possibly extending

into the following week.

Market participants are expecting pulls ranged from 237 Bcf to 257 Bcf with

consensus formed near a 247-Bcf withdrawal.

The pull will compare bullish against a 131-Bcf five-year average draw and

the 117-Bcf pull reported for the corresponding week in 2014. At consensus, the

draw would bring natural gas inventories to 1,910 Bcf, reversing the

year-on-five-year-average storage surplus of 58 Bcf left after the 111-Bcf

withdrawal reported by the EIA for the week to Feb. 13, to a deficit of 58 Bcf.

The data has the potential to move March futures higher in its final day on

the board and could keep support under the soon-to-be lead April contract, with

its bullish comparisons and the implication of a tightening supply/demand

balance.

“So far the market has been quite tolerant, even complacent regarding both

the current cold snap itself and its likely impact on storage levels, but we

continue to see potential for a short covering rally to $3.20 or more over the

next few weeks,” Citi Futures analyst Tim Evans said.

Still, natural gas inventories currently stand at 2,157 Bcf, 678 Bcf above

the year-ago level, and are on track to end the season well above the 822 Bcf

left in storage at the end of 2013-2014 winter heating season.

With eyes shifting to April futures, the contract closed out the prior

session down 0.4 cent at $2.889/MMBtu and extended losses overnight. Finding a

$2.866/MMBtu to $2.911/MMBtu range, the contract was last down 1.2 cents at

$2.877/MMBtu.

In spot trade, cold weather lost its impact on the markets as slight trends

toward warming will equate to lower demand.